While it may not be the most glamorous real estate investment , buying bare land can be a good investment — if you understand how to invest in land properly like a real estate developer . Land investments can produce high returns, passive income, and large profit margins.

But like other types of investments, investing in land profitably comes down to thorough due diligence. Let’s dive in to how to invest in land, why you might want to, and important things to know before you buy vacant land.

What is bare land?

There are three types of real estate investments — commercial property, residential property and land. Vacant or bare land is a plot of land without any established buildings or equipment that can be used for the development of commercial or residential real estate or for farmland, ranches, or natural resources such as mineral, water, or air rights.

In essence, when you invest in land, you are buying untouched, bare land, that has not been developed. The zoning of bare land is very important because it determines how the land can be used for future development. There are eight main categories of land use:

- Residential

- Multifamily

- Commercial

- Industrial

- Public or semi-public (like a library, public school, or bus station — also called institutional use)

- Parks and open space

- Agriculture (which can include farmland or forestry)

- Right of way (which is an easement that gives people access to their property through another piece of land or parcel)

There are several subcategories within these eight main land-use types that determine what size the development that can be based on the area’s density, or the type of property that can be built or not.

Why invest in land?

While not all land holds equal value, in general, there are a number of advantages to buying raw land.

Good return on investment

Like residential or commercial investing land can produce passive income or large profits depending on how the land is purchased and sold. I have several colleagues who specialise in buying land and have done extremely well for themselves over the years. It’s possible to make high-double-digit returns if you buy the right piece of land at the right price, and there are ways to earn residual passive income with vacant land.

Low cost

The value of land varies depending on the location, type of land, and the amount of acreage being sold. Some bare land can cost hundreds of thousands of rupees to millions of rupees, while other vacant land can cost just a few thousand rupees. For most people, land can be a low-cost investment that doesn’t require a bank loan to get started.

More land isn’t being made

Land, in general, is in demand. As our population grows, the need for land to develop grows with it. And there is only so much land available.

Little to no maintenance

Bare land is undeveloped, meaning there is no property to maintain or tenants to deal with. Aside from paying property taxes and keeping the land mowed or secured, it’s a relatively low-maintenance investment.

Large opportunity

Land investing faces less competition than residential and commercial real estate investing. So if you want to grow your passive income, land holds a lot of opportunities. While there are definitely other land investors out there, in general, there is more land than there is competition, which means you can find really good deals if you’re willing to do some extra homework.

Ways to invest in land

Just as there are several ways to invest in residential or commercial property, there are multiple ways to invest in land. Below are some of the more common methods of buying and selling raw land.

Flipping land

Flipping land is one of the most popular methods of land investing and simply means you buy a parcel of land for a low price and sell it later for a higher price. Places like tax sales or foreclosure auctions can be great places to find low-cost land that can be flipped for good returns.

Flipping land can be as simple as buying low and selling high, but some of the largest profits can be made by getting the proper entitlements to the property to add marketability. Entitling could include doing the work to get the property zoned or re-zoned, cleared for development, subdivided, or permitted for builders. Doing this work adds value because it saves the prospective buyer time, cost, and risk since entitling is already done.

Developing Bare land

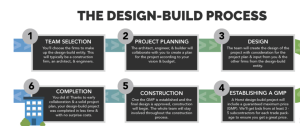

Some investors buy land to develop it themselves. While this can be a profitable venture, it can also be a long and costly process. If you want to develop commercial or residential property, building from the ground up, buying bare land in a suitable location and zoning will inevitably be a part of the process with Beverlee Holdings by your side, we provide absolute testing and property checks through our Technical Team to ensure you’re getting the best.

Buy and hold

Some land investors will buy raw land with the intent to hold the land long term. They may want to develop the land in the future, want to wait for the demand to increase (thus increasing the value of the land), or want to hold their land rights, which could include water, air, or mineral rights. While the landowner holds the property, they are responsible for paying annual taxes and maintaining the property as required.

Buy and lease

If the goal of owning land is to create a passive income stream, which is residual income that is paid to the investor monthly — the landowner can lease the land for a third party to use. For example, if the land investor owns 40 acres of farmland, rather than farming the land themselves, they can lease the land to a farmer. The farmer pays the landowner monthly rent and is responsible for the land development and maintenance of the land, including paying taxes.

At Beverlee Holdings Pvt Ltd, we pride ourselves in utilising innovation and to elevate the Sri Lankan property investment landscape. Whether you are looking for house designs, interior design assistance, commercial property construction or a complete renovation of your home or office, Beverlee Holdings holds the professional capabilities to assist you with your real estate needs.